At CIGP, we believe in innovation and remain at the forefront of financial markets combined with technology to create value for our clients.

Our quantitative research division marry investment expertise with best-in-class quantitative techniques to create investment strategies. After years of research, we developed our proprietary AI-based quantitative investment framework named Sib. Extensively trained and continuously learning, Sib generates actionable insights from a broad range of data.

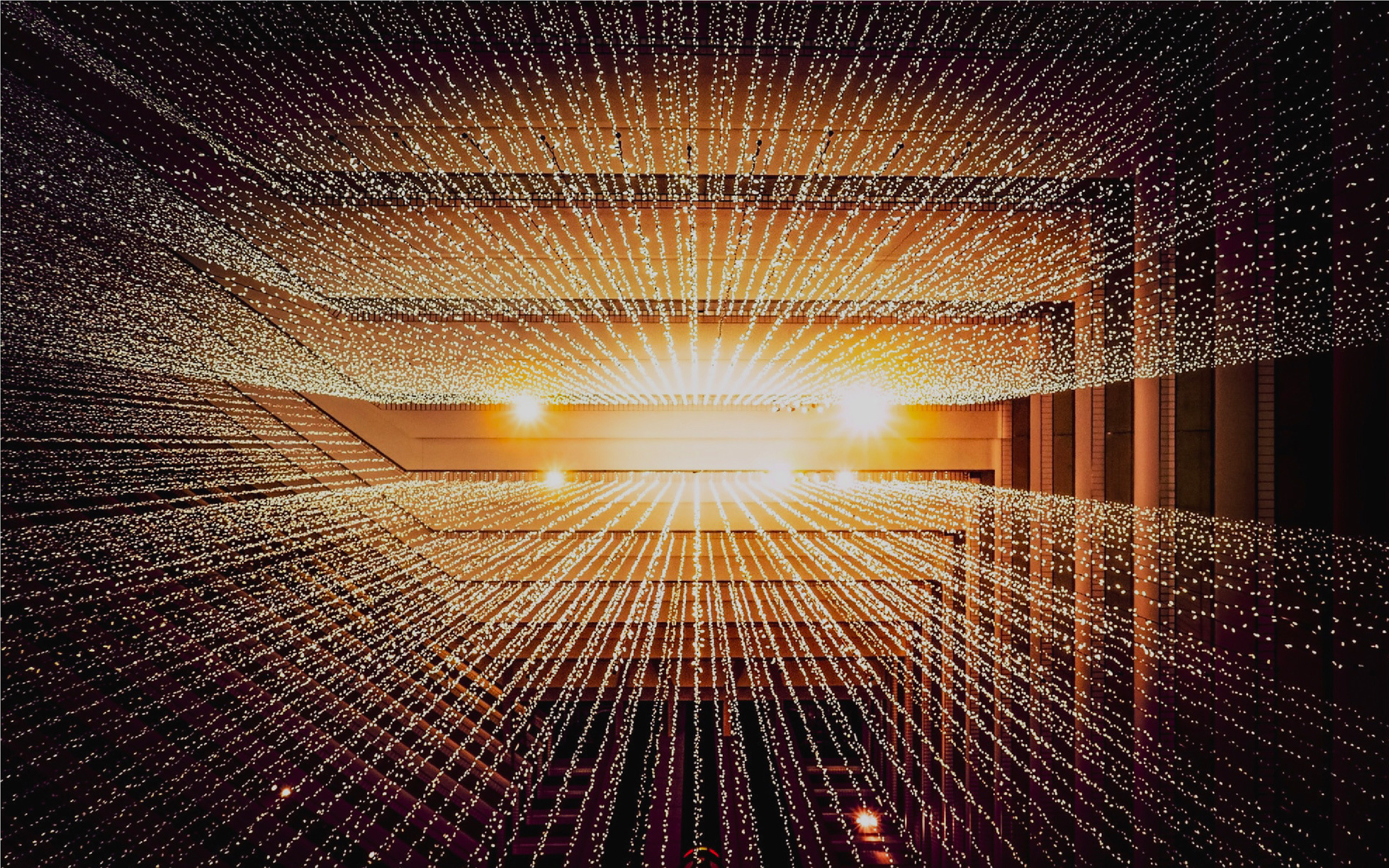

Information is crucial to make well informed investment decisions. Recently, the big data revolution generated an unprecedently high volume of powerful signals, which cannot be handled by humans. This includes non-financial information, commonly known as alternative data, ranging from sentiment and social data, to web traffic and search volume for specific terms. At CIGP, we leverage the power of big data to anticipate market movements, identify opportunities, and mitigate downside risk. To handle the volume of data we collect and process every day, our technology systematically analyzes and combines feeds to create proprietary indicators.

We believe the power of AI, Machine Learning, and scientific methods applied in a unique and innovative manner can help capture alpha and create value for investors. Capable of processing information faster than humans, Sib copes with ever-changing market conditions, thrives in volatility and never stops learning. By identifying patterns and correlations, Sib connects the dots between data signals and events to produce unbiased investment recommendations in various asset classes, industries and enterprises all around the world.

We do not aim to replace finance professionals with technology, but to extract and combine the highest potential of both sides. Idea generation is the core of our research process, we leverage our investment expertise to find new trends, source relevant data and develop investment theses. Always evaluating new hypothesis, our quantitative research team continuously improves and develops new models to achieve the highest standards. After extensive refinement and backtesting, we enrich Sib with new strategies to stay ahead of the curve and realize superior performance across a broad range of assets.

To explore how our quantitative investing approach could work for you, feel free to contact our team.