Global M&A Outlook 2020

The M&A activities have been continuously active since 2008. But due to the trade tensions and economic uncertainty, M&A activities have been cooling down from 2019.

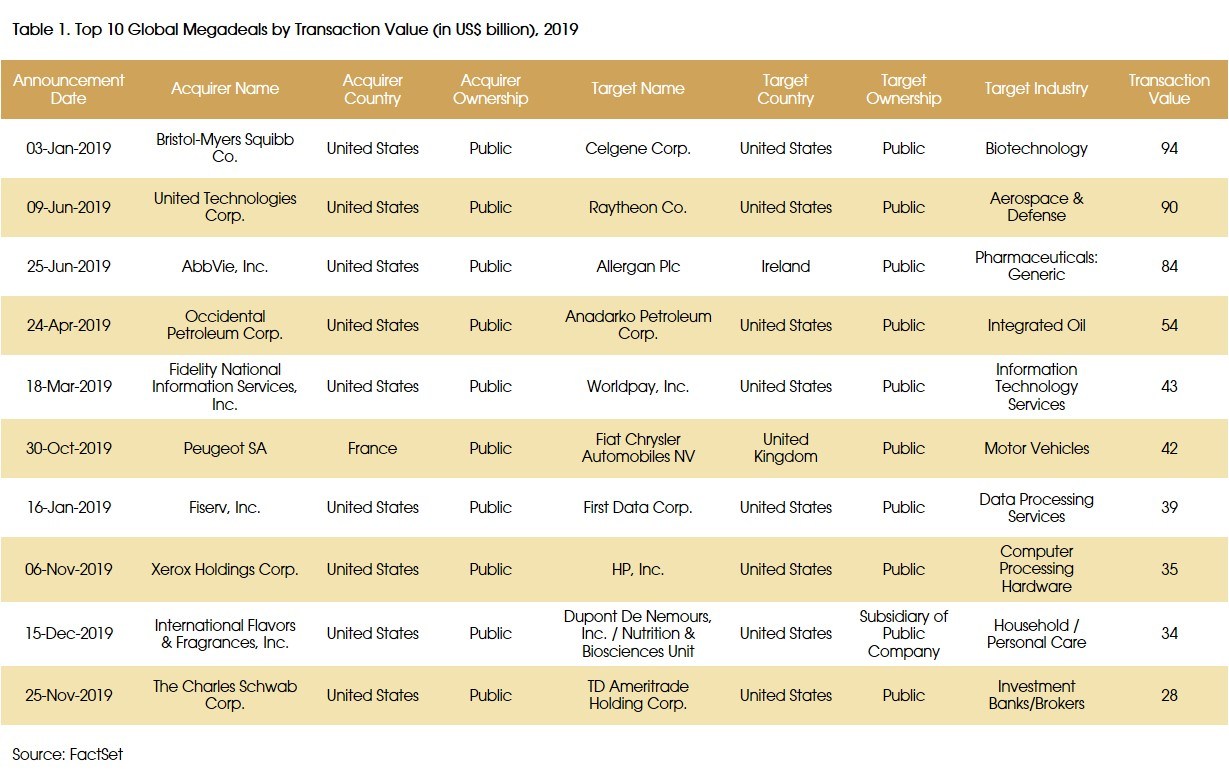

Although overall deal value and volume declined, 2019 witnessed announcements for some of the largest deals in industries such as pharma and aerospace. Technology remains the focal point of cross-sector M&A, through which many companies acquired new capabilities and transformed their businesses.

Overall, 2020 will follow a similar pattern to 2019. Issues such as a slowing economy, geopolitical strains and regulatory demands will be the headwinds for the M&A environment. Besides, US presidential election and uncertainty about what administration will be in power in 2021 could also influence the deal decisions within the year. However, strategic transactions will remain a hot sector as companies continue having a demand for M&A to strengthen their businesses.

2019 in Reviews

Following a strong 2018, the global M&A market slowed down in 2019. Global M&A activity in 2019 decreased by 6.9% from the exceptional 2018 to US$3.33 trillion (across around 19,300 deals). Dealmaking slowed down notably in the latter part of the year, with 2H19 recording a 24.2% decline in value versus the first half. (1) Here are the M&A trends that emerged in 2019 and are likely to further influence dealmaking in 2020:

1. Key Trends:

- Megadeals were prominent in North America:

In 2019, there were 47 megadeals announced globally, 36 of which were announced in North America. And 23 of the 36 megadeals in North America were announced in the first half year before the region was affected by slowing global growth. (2)

- Companies continued to focus on core assets through divestitures and spinoffs:

12 of the top 20 global transactions (60%) were related to divestitures, spinoffs, splitoffs, or corporate clarity. It was driven by increased pressure from shareholders who saw little synergies between businesses and therefore required companies to spin off or divest irrelevant assets to achieve growth strategy. (2)

- The regulatory environment remained challenging:

The number of blocked deals on antitrust grounds has been growing over the past two decades. Mega-combinations in specific sectors are facing increasing pressure from government scrutiny, such as the consolidation of the U.S. mobile market (T-Mobile & Sprint and Telefonica O2 U.K. & Hutchison Whampoa) as well as metals and mining sectors (BHP & Rio Tinto’s Western Australia Iron Ore JV). Since 2000, the global average of transactions blocked has been 4% annually, with the highest share aligned to the most consolidated markets of North America (52%) and Europe (27%). That percentage has increased to 6% on average over the past four years. (2)

- Scope deals continued to gain momentum in 2019:

Scope deals, which are defined as deals intended to enter faster-growing segments or to acquire new capabilities for future growth, have gained momentum continuously in recent years as companies are demanding more disruptive technology and looking for more opportunities to expand their business scope. In 2019, scope deals accounted for 58% of strategic deals with more than US$1 billion in deal value in 2019, up from around 50% in 2018 and 41% in 2015. (3)

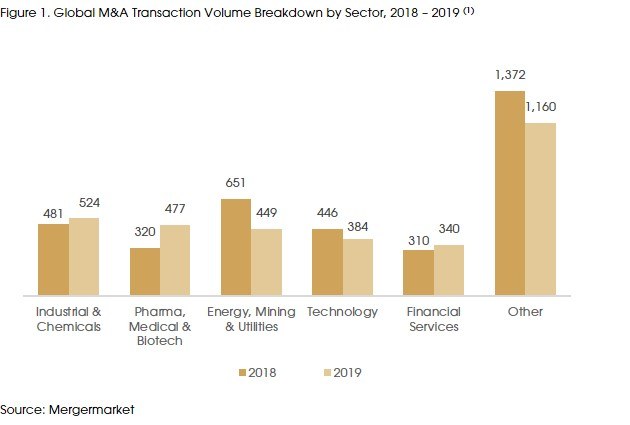

2. Sector Overview:

The top sector in 2019 by deal value was Industrial & Chemicals which increased by 9% to US$524 billion from US$481 billion in 2018. (1)

Pharma, Medical & Biotech was the second largest one, up by 49% drastically to US$477 billion from US$320 billion in 2018. (1) This was mainly attributed to the two megadeals: BMS & Celgene (US$94 billion), the largest pharma deal on record, and AbbVie & Allergan (US$84 billion), together accounting for 37% of total value in the sector. (4)

The Energy, Mining & Utilities sector tumbled with US$449 billion, a 31% drop from US$651 billion in 2018. (1) This was mainly due to the increased volatility in commodity prices. Specifically, Oil prices have been experiencing great volatility due to Saudi Arabia’s reduction of oil output in September and US – ME tensions.

3. Region Overview:

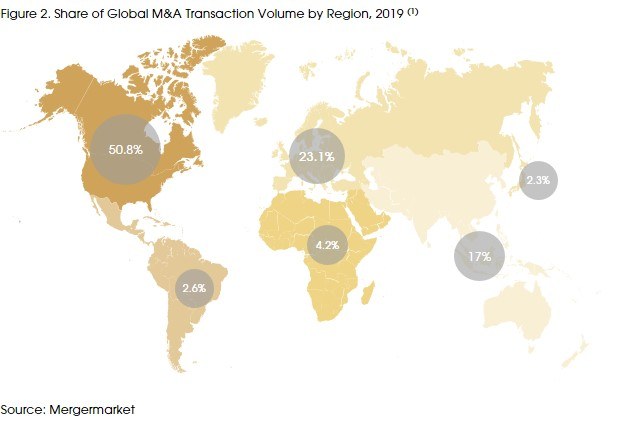

- North America took the lion’s share:

North America was home to 50.8% of global M&A activity in 2019, thanks to a relatively strong economy and a number of large deals. The largest deal was United Technologies’ US$89 billion merger with Raytheon in the defence and aerospace sector. However, both Europe and APAC (excl. Japan) saw the drastic decrease of 21.9% and 22.5% in deal value compared to 2018. (1)

- Global cross-border on the decline:

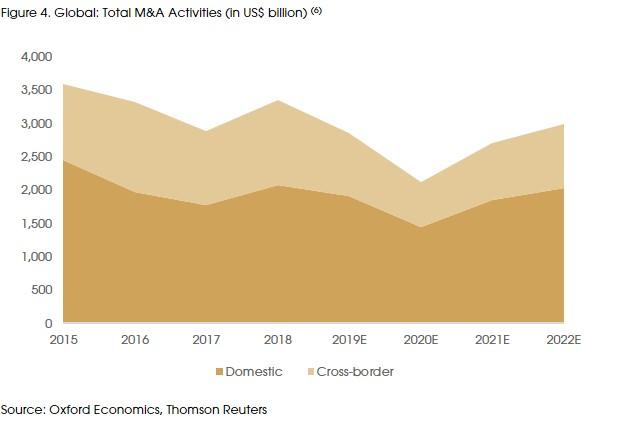

Global cross-border transactions during 2019 totaled US$1.27 trillion, declining by 6.2% compared to 2018. (1) This decrease has been driven by a more protectionist sentiment, lower levels of China outbound M&A activity, concerns over Brexit, and more muted market activity throughout EMEA. Growing protectionist policies led to companies focusing more on domestic M&A.

Europe has been the most popular destination, however its transaction volume has seen a huge decline of 30.3% YoY to US$316.5 billion. US has been the most active acquiring country, even though its acquisition interests of overseas assets have dropped by 2.9% to US$335 billion by transaction volume. (1)

Outlook for 2020

1. Key Trends

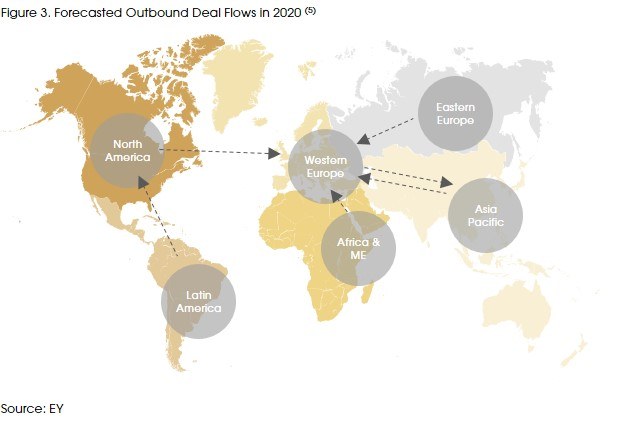

- Western Europe remains a popular destination for global outbound investments:

European companies remain desirable targets due to its high-quality assets and lower valuations.

Meanwhile, the deal flows between Europe and Asia are strengthening. Asian investors want to acquire European intellectual properties while European companies want to tap into Asian market with stronger growth potential. With increasing regulatory uncertainties and geopolitical risks, both sides are thinking of the longer-term opportunities.

- The potential recession may lead to a return to scale dealmaking:

Indicators such as inverted bond yields and manufacturing contraction have intensified the fear of recession. In a downturn, scale dealmaking could be back in favor. Companies of similar size will likely continue to combine in an effort to enhance free cash flow, dampen earnings volatility, and create a larger creditworthy company that is able to withstand potential uncertainty.

- Technology remains a key target in deal market:

As the pace of technological change continues to increase, it’s expected that companies across all industries will focus on a digital transformation strategy as the key to growth and remain competitive. Compared to in-house development, M&A is still the fastest route to acquire tech capabilities. Hence it is expected to continue to see tech acquisitions in the coming future for companies to accelerate their growth agendas and digital strategy.

2. Regions Outlook (6):

Based on the data provided by Baker McKenzie, although 2020 is anticipated to see a deeper downturn in both domestic and cross-border dealmaking due to the increasing geopolitical uncertainty (such as Brexit and US – Iran tensions) and the risks of a global recession, acquisitions will remain a vital growth strategy for enterprises from all major industries, driven by the demand to defend against technological disruption. Medium-term drivers of transaction are more positive beyond 2020.

- North America: There could be a short-term deceleration in 2020, due to the uncertainty brought by the economy slow down, a possible equity market correction and the upcoming presidential election. Activity should then pick up from 2021-22 as the global economy stabilizes, and enterprise confidence returns.

- Asia Pacific: Deal activity has cooled in the Asia Pacific region in 2019, particularly in terms of cross-border activities, which is a trend expected to continue into 2020. The current breakout of Coronavirus in China, which soon spread across Japan and Korea, will also significantly dampen the region's activism in M&A market. However, a modest resurgence should surface the following year, due to a stabilization of liquidity conditions and improvement in equity markets.

- Latin America: Deal activities may slow down in 2020, due to the increasing volatility of global economy. Activity should then pick up from 2021 due to three key drivers: Argentina’s expected recovery from recession in 2021, a recovering external environment, and more supportive commodity prices.

- Middle East: Deal activities are expected to be cooled down in this region in 2020 due to the slowing world economy, US – Iran conflict and volatile oil prices. It should be noted, though, that Saudi Aramco, taking a 70% stake in petrochemical firm Saudi Basic Industries, could provide a US$69 billion spike. (4)

- Africa: A pause may occur in 2020, due to the increasing volatility of global economy. Activity should then pick up in the following years, benefiting from consolidation in the energy and mining sectors. Consumer staples will also be attractive for investors seeking access to the region's growing middle class.

Conclusion

An increasingly complex landscape that influenced M&A is likely to endure in 2020, given potential turbulence in the global economy and increasing volatility in foreseeable future. The upcoming US presidential elections will also bring additional risk and complicate the global M&A market. Dealmakers will need to navigate multiple challenges in 2020 and here are some key takeaways for the ongoing 2020:

- Due to the fear of potential recession, 2020 will see a further decline in global M&A market, however, macro drivers should become more conducive to dealmaking from 2021 onward.

- The number of cross-border deals may decline as geopolitical tensions intensify. The government will likely continue reviewing foreign investments through a stricter lens.

- Europe may continue to be the top destination for cross-border M&A in the short term, while the deal flows between Europe and Asia are also strengthening.

- Scale deal may continue to increase as companies of similar size will likely continue to combine to strengthen their business particularly during periods of prolonged uncertainty.

- Regardless of market conditions and across all sectors, companies that can leverage the historic amount of capital available and make the right adjustments in the face of these headwinds should be resilient enough to invest in growth in 2020.

- Increasing allocation to digital transformation remains crucial to future growth. Companies on the lookout for a technological competitive advantage will seek out acquisitions to enhance their digital capabilities.

According to the Global Capital Confidence Barometer, a regular survey conducted by EY, interviewing senior executives from large companies worldwide (over 75% of the surveyed companies reached an annual revenue greater than US$500 million), the intentions to make cross-border transactions are still above long-term average. 52% of the respondents have the plan to actively pursue M&A in the coming twelve months and 68% of the respondents expect the M&A market to improve in the short term. (5)

Overall, a volatile global market also creates opportunities. Companies will always find deals to acquire capabilities, reshape portfolios, and accelerate growth. Indeed, M&A remains the fastest route to build optionality for companies to respond to the evolving challenges proactively.

For further information, please address your queries to advisory@cigp.com. For more information about our capabilities and a selection of our Case Studies, click here.

Sources:

(1) Global & Regional M&A Report 2019, MergerMarket;

(2) 2020 Global M&A Outlook, JP Morgan, Jan 2020;

(3) Corporate M&A Report 2020, Bain & Company, Jan 2020;

(4) FactSet, Feb 2019;

(5) Global Capital Confidence Barometer, Ernst & Young, Oct 2019;

(6) Global Transactions Forecast 2020, Baker McKenzie.