Investment Banking: CIGP & Jett Capital successfully advised Alpha Fine Chemicals on its latest funding round

Alpha Fine Chemicals Limited (“AFC” or “the Company”), an innovative player in the lithium-ion battery supply chain based in Australia, today announced that a consortium of investors including the Traxys Group (“Traxys”), a Tier 1 miner[1], and CIGP together with current shareholders and management have made an investment into AFC through the purchase of convertible notes to fund working capital and due-diligence costs associated with the financing of AFC’s 40,000 tpa nickel sulphate plant to be located in Thailand.

The Company recently entered into exclusive negotiations with regards to a US$70 million project finance facility with KfW IPEX - Bank and is expecting to reach financial close in the course of this year, subject to customary confirmatory due-diligence.

In addition to the new capital, the Company has entered into exclusive negotiations with the Tier 1 miner and Traxys with regards to raw material feedstock supply and battery grade finished product marketing arrangements, as well as the provision of a US$15 million cost overrun support facility and a US$15 million working capital facility.

Norman Taylor, founder and Executive Chairman of AFC said that “whilst there is still much to do to bring this project into production, the addition of groups of this calibre is a significant step forward. We will work as diligently as possible with our funding partners to achieve financial close as soon as practicable to allow the project to move into the construction phase. Beyond this initial project, AFC is excited about working with Traxys and the Tier 1 miner on further nickel sulphate projects in either Thailand or elsewhere.”

With a record number of new battery mega-factories being announced, AFC’s 40,000 tpa Thailand plant will be well positioned to capture a share of this growing market opportunity by providing sustainably produced nickel sulphate together with by-products in cobalt carbonate and magnesium sulphate using its proprietary CMN Process technology. The CMN Process allows AFC to refine various intermediate nickel products, such as Black Mass from the recycling of Lithium-Ion batteries and Mixed Hydroxide Precipitate (MHP) whilst it is also exploring additional feed options.

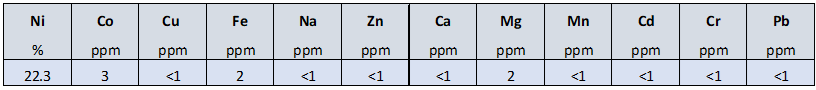

Independent assays of nickel sulphate produced from the recent pilot plant confirms the very high purity of product that AFC will produce:

The CMN Process will allow AFC’s Thailand plant to produce high-purity nickel sulphate with the lowest environmental impact to serve the growing EV market. The environmental credentials of the CMN Process are illustrated by the fact that the Industrial Estate Authority of Thailand has confirmed that the project does not require any environmental impact assessment. However, to serve the highest environmental and social standards, AFC has nevertheless elected to conduct an environmental impact assessment and will ensure that the project will be in line with the IFC Performance Standards. AFC has also received promotion from the Thailand Board of Investment, granting AFC significant benefits including zero tax on nickel sulphate and cobalt carbonate for the first eight years of production.

The plant will be located in Amata City Rayong, a world-class industrial estate in the eastern economic corridor and is expected to generate in excess of 110 highly skilled jobs.

Valentin Ischer, CIGP’s Executive Director, mentioned “We are extremely proud to have helped AFC achieve a very significant step in their funding strategy for their Thai Nickel Sulphate plant and beyond. Our team’s ability to source a mix of financial and strategic partners as well as CIGP’s ability to co-invest alongside these Partners, played a key role in securing this round of funding and further demonstrates CIGP’s commitment to a sustainable future”.

Norman Taylor commented that “AFC has been very fortunate to have CIGP as a Financial Advisor for this fund raising. CIGP’s industry knowledge, and the quality and breadth of its investor network has been invaluable to AFC achieving this milestone. Above all, the professionalism and integrity of the CIGP team has been both highly impressive and appreciated by AFC.”

Convertible Note Terms

AFC may raise up to an aggregate principal amount of US$10 million in Convertible Notes (the “Notes”). The Notes carry a coupon of 5% and will convert at a discount to the issue price for the upcoming main equity round, expected to close in Q2 or Q3 2022. AFC will settle its coupon and conversion obligations through the delivery of Ordinary Shares in AFC.

About AFC

AFC is based in Perth, Western Australia. Following the demerger of it’s mineral tenements to form NickelSearch Limited (ASX: NIS) in 2016 the Company has focused on commercialising the CMN Processing technology for which it holds the global exclusive rights for the production of nickel sulphate. AFC retains a Right of First Refusal over product produced by NickelSearch.

About Traxys

Traxys is a privately held physical commodity trader and merchant in the metals and natural resources sectors. It is headquartered in Luxembourg with an annual turnover in excess of USD7 billion.

About KfW IPEX Bank

KfW IPEX Bank is the international project and export financing arm of the KfW Banking Group. KfW is a German state owned investment and development bank based in Frankfurt.

Advisors

CIGP and Jett Capital Advisors are serving as financial advisors to AFC.

About CIGP

CIGP Group is an independent financial advisory firm, rooted in Geneva for more than 50 years, providing investment banking services and wealth & asset management to its clientele. CIGP Group focuses on advising entrepreneurs and their families on strategic matters and currently manages assets with approximately US$2 billion, invested across asset classes globally. Over the past decade, CIGP has expanded internationally to Milan, Dubai, Hong Kong and London.

About Jett Capital Advisors

Jett Capital Advisors is an independent boutique investment bank servicing international public and private companies specializing in the natural resources and clean technology sectors.

Enquiries:

AFC |

Jett Capital Advisors |

CIGP |

Norman Taylor |

Valentin Ischer |

|

+61 413 044 687 |

+1 212 616 0430 |

+852 5229 0925 |

This announcement is neither an offer to sell nor a solicitation of an offer to buy any of these securities and shall not constitute an offer, solicitation, or sale in any jurisdiction in which such offer, solicitation, or sale is unlawful. The Notes and any Ordinary Shares issuable upon conversion of the Notes have not been registered under the U.S. Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements.

[1] Identity cannot be disclosed due to confidentiality obligations until the exclusive negotiations are finalised.